ISSN: 2158-7051

====================

INTERNATIONAL JOURNAL OF

RUSSIAN STUDIES

====================

ISSUE NO. 3 ( 2014/2 )

|

ISSN: 2158-7051 ==================== INTERNATIONAL JOURNAL OF RUSSIAN STUDIES ==================== ISSUE NO. 3 ( 2014/2 ) |

COMMENTS ON THE IMPACT OF KNOWLEDGE ON ECONOMIC GROWTH ACROSS THE REGIONS OF THE RUSSIAN FEDERATION

JENS K. PERRET*

Summary

Using a basic growth accounting approach it is

deduced how far the regional knowledge infrastructure plays any significant

role across the regions of the Russian Federation. Aside from aspects of the

size of the regional innovation system, like the number of researchers and

students, it is discussed in how far the inflow and outflow of knowledge plays

a role in determining the economic growth. The study shows thereby that while the Russian

growth dynamics are indeed driven by the exploitation of natural resources,

foremost of oil and gas, a significant part of Russian growth is due to its

innovation system. This shows that innovation oriented growth politics as

promoted by former president Dmitry Medvedev do have a solid foundation to be

built on.

Keywords: Economic Growth, Russian Federation,

Knowledge, Innovations.

Introduction

Not only since the works by Machlup[1],

who described the modern society as a knowledge society, has the aspect of

knowledge as a production factor and an essential building block of economic

growth been acknowledged.

A broad range of studies exist that have reported empirical results on

the importance of knowledge in economic growth. However most

of these studies focus on Western Europe, the European Union, its member

states, the USA or other highly developed economies. A smaller range of

studies focuses on how knowledge, and in specific the inflow of knowledge, can

facilitate economic growth in developing economies, especially those in

transition.

Internationally the Russian Federation is generally considered as a

provider of basic resources or low quality goods. Only a few authors have

considered the Russian innovation system and thereby the contribution of

knowledge to Russian economic growth. In some part this shortcoming is

motivated by the lack of suitable data.

In the present study this research gap is filled by providing an insight

into the effects regionally domestic knowledge sources, as well as

intra-regional knowledge flows, have on Russian

economic growth.

In the following second section the research design is presented while

in the third section the results from a dynamic spatial panel regression are

presented and discussed before in the fourth section some preliminary

conclusions are drawn.

Knowledge Extended Growth Accounting

Using a growth model approach, this section argues how different sources

of knowledge, knowledge spillovers and the absorptive capacity, influence the

economic situation in the Russian Federation, measured by the GRP. A number of

studies like Guellec and and van Pottelsberghe de la Potterie (2004) exist that

analyze the importance of R&D and the institutional environment on the

output of an economy. For the Russian Federation, however, Ahrend (2002) argues

that political and institutional features are almost unimportant and can

therefore be left out of a growth-related analysis.

In addition to the knowledge inputs generated inside the region,

knowledge inputs generated outside the region that enter the region in the form

of interregional spillovers and through international channels of knowledge

transfer like foreign trade or direct investments are considered.

From a theoretical point of view the model picks up on the Solow growth

model, assuming an influence of the labor and capital inputs on the level of

the GRP. However, the most interesting aspect lies in modeling the Solow

residual.

Finally, the new economic geography stresses the importance of the

underlying spatial structure, motivating thereby the implementation of spatial

models.

The model underlying the following estimations is always considered to

be in log-linear form. Therefore, all variables, as long as they do not

represent a quota or percentage, are logarithmized versions.

As the state-owned sector makes up a comparatively large share of total

production, but might be considered less efficient than the private sector[2],

and the amount of government personnel can also be interpreted as a proxy

variable for corruption, which should also have a negative effect on growth,

government personnel is included as a control variable[3].

Partially hand in hand with the importance of state-owned firms goes the

share of natural resources in the Russian economy, of which the oil and gas

sector comprises a significant share; therefore, the amount of produced oil and

gas is included into the model as well. Here the hypothesis of the resource curse can be recalled, as it

proclaims a negative relation between the development of the GDP and the amount

of non-renewable natural resources - especially natural oil and gas[4].

The knowledge input side of the economy is represented by four

indicators: the number of researchers, the expenditures on R&D, the number

of students and the number of patents granted. As spillover effects are to be

included in the model as well, but respective indicators are only available for

patents granted by the EPO, only patents granted by the EPO are considered in

the analysis.

Finally, from an international perspective, the exports and imports as

well as the openness indicator - to give a general insight into the integration

of a region into the world economy - are considered[5].

However Lichtenberg and and van Pottelsberghe de la Potterie (1998) argue that

it is not so much the intensity of the imports, and thereby the exports as

well, but the distribution of the countries of origin or their destination that

influence economic development. The trade related indicators are accompanied by

the amount of FDI inflows - as another channel through which knowledge can

enter a region[6].

Running a series of tests on a first basic model reveals that only the

fixed effects model will produce reliable estimates for the model, and it also

suffers from heteroskedastic error terms. The ongoing analyses therefore rely

on robust standard errors.

Application of a Moran's I test and robust Lagrange multiplier tests for

spatial autocorrelation effects reveal significant spatial autocorrelation

effects.

Further testing shows that the model suffers from serial autocorrelation

as well. Summarizing these results leads to the use of the

Blundell-Bond estimator for dynamic panel models in the context of a Han

Philips Spatial Dynamic estimation method[7].

To account for a structural break, which is rather likely in the event

of the crisis in 1998, the total time frame has been divided into the

transition years including 1998 and the later years starting with 1999. To test

for a structural break in levels a dummy variable for the transition years is

included in a first regression (model I). In two other regressions the

transition (model II) and the later years (model III) are considered

separately.

Since the correlation matrix for the independent variables suggests that

some of the variables are highly correlated, variance inflation factors are

calculated, revealing that severe problems with multi-collinearity exist.

Testing different reduced versions of the basic model leads to the result that

it can be cleaned of multi-collinearity - or rather of variables reporting variance

inflation factors larger than ten - by omitting the labor and capital

variables, which are highly correlated with each other as well as with the

researchers, R&D expenditures and government personnel.

The expenditures on R&D have been removed as well since they are

highly correlated with the researchers and the government personnel.

As a fourth variable, either the researcher or the government personnel

variable needs to be removed from the equation. While removing the researchers leads to a qualitatively better model in

general, their removal would also exclude an essential insight on the influence

of the tacit knowledge potential on the economic development across regions.

Therefore, two basic models have been estimated - one with researchers and one

with government personnel. The model implementing government personnel is

considered as well as a stability test for the results of the researcher model.

While it can be argued that the approach is no longer valid since labor

and capital variables as base variables of the underlying production function

structure had to be excluded, the approach here can be seen as measuring the

effect of mostly knowledge-oriented inputs that influence economic growth aside

from labor and capital, which are natural drivers of economic development and

growth nonetheless. Referring to the neoclassical growth model, this reduced

version is basically an approach to quantify the Solow residual.

Empirical Analysis

While the patent variable and the spillover variables are based on

patent data by the European Patent Office all other variables are based on the

regional statistical yearbooks by Rosstat.

Data has been used for the years 1994 to 2009 in a first model which

does not include spillover effects and for the years 1994 to 2006 in a second

model which includes spillover effects. Therefore, the estimation considers

sixteen or thirteen years and 80 cross-sections each[8]

leading to a total of 1,280 or 1,040 observations respectively.

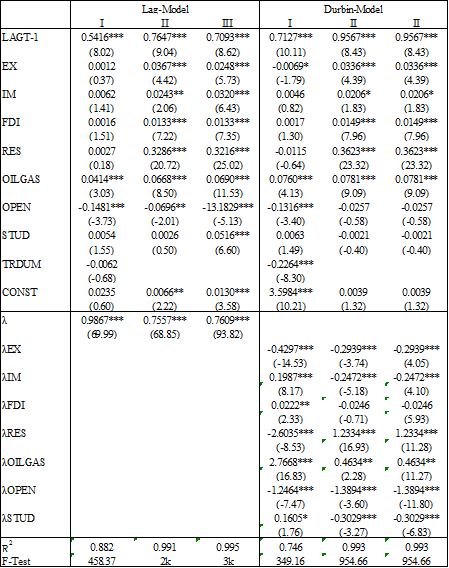

Table 1: Regression Results

using Researchers

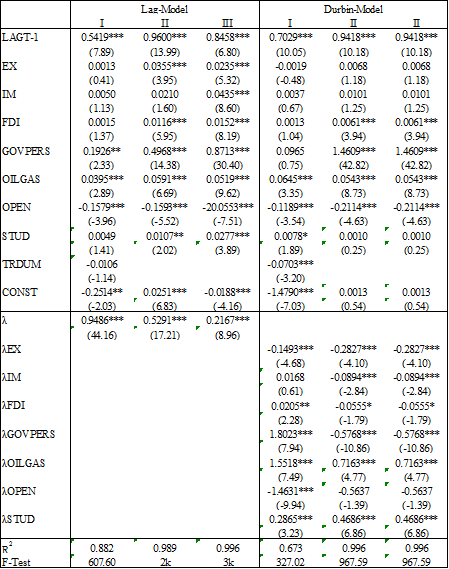

Table 2: Regression Results

using Government Personnel

For reasons of multicollinearity researchers and government personnel

are not implemented together, therefore Table 1 summarizes the results for the

model without spillover effects including the researcher variable while Table 2

summarizes the results for the model without spillover effects including the

government personnel variable[9].

Comparing the tables there is no big difference in the signs of the

coefficients whether researchers or government personnel are used as a

variable. Quality indicators like the R2 and the F-test yield

similar results for the lag-model; with the Durbin model the F-statistics are

significantly larger in the case of using the government personnel variable.

However, they are a first indicator that the results are stable.

Additionally, when comparing the results for the spatial lag and the

Durbin model the variables retain their signs even though a few lose their

significance the quality statistics indicate largely comparable results.

Considering the signs of the variables themselves most of them represent

results expected from economic theory. The only exceptions are the positive

impact of imports, the negative impact of openness and the positive impact of

the government personnel.

However, the positive impact of imports can be explained by assuming

that the positive relation is not a direct effect but rather represents the

effects of an antecedent variable. Having a better economic situation in a

regions leads on the one hand to higher GRP values and on the other it leads to

a larger number of wealthy inhabitants who in turn are more interested in

acquiring foreign products.

On the other hand it can be assumed that a region that is producing

efficiently also requires quality equipment which in turn is imported from

abroad - a similar argument holds for foreign direct investments as well which

on the one hand raise the economic output of a region but on the other hand

might lead to higher imports of intermediate goods.

Nevertheless, a peculiar result is the consistently positive impact of

the government personnel which, from the perspective that state ownership

generates less efficiency as well as from the perspective that the number of

government personnel can be used as a proxy for the level of corruption, can be

seen as counter intuitive. Especially, since the comparatively large

coefficient implies that a doubling of the amount of government personnel will

lead to unrealistically high growth rates. This effect might be generated via

the large share of government activity in the sector of natural resources which

biases the analysis from the start.

Considering that the spatial lag variable is highly significant in the

spatial lag model and that most of the spatially lagged variables in the Durbin

model are highly significant this shows that there are important links between

the regions. This goes along with the consistently positive and highly

significant lagged variable which shows that economic growth across the regions

of the Russian Federation is highly path-dependent.

Regarding the size of the coefficients the most important result of this

study stems from comparing the researchers and the oil and gas production

coefficients. While a doubling of the amount of produced oil and gas only

results in raising the GRP by roughly 5% to 7%, a doubling of the amount of researchers results in raising the GRP by roughly 25% to 32%[10].

Even considering that the results might be biased by measurement errors it

shows the remarkable importance of the research sector for the economic development

of the Russian regions. Furthermore, it strengthens the hypothesis that

investments in Russian high technology, research intensive sectors is not only

more sustainable in the long term, but has consistently - even in the

transition years - been driving the Russian regional development process.

Additionally, the importance of FDI inflows is even less significant for

Russian growth as a rise of FDI inflows by one percent only leads an additional

0.01% of economic growth. However it needs to be considered that on average it

is much easier to double the inflow of FDI than doubling the output of the oil

and gas sector.

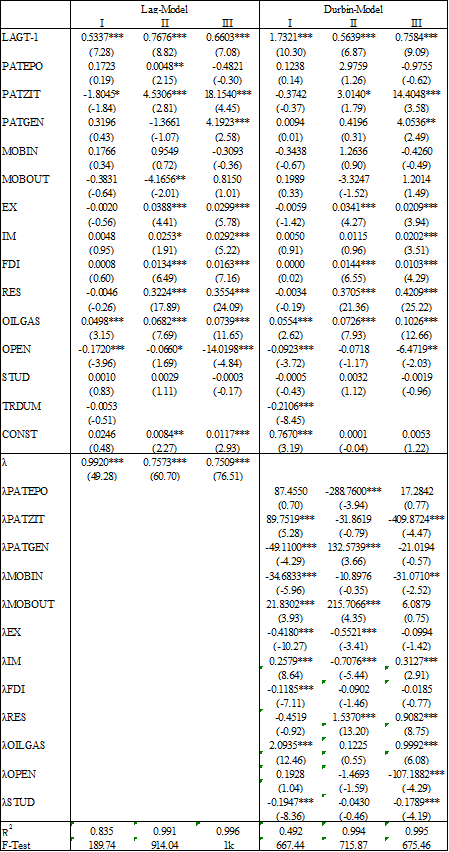

Table 3: Regression Results

using Researchers – Extended Model

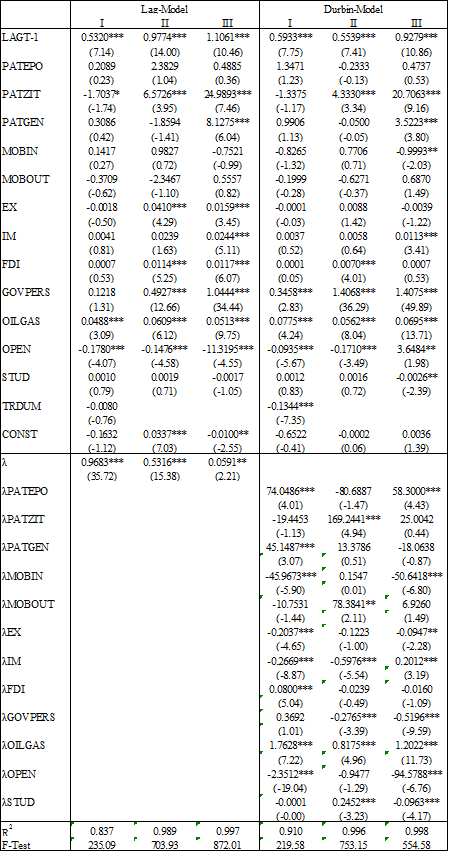

Table 4: Regression Results

using Government Personnel – Extended Model

The consistently significant spatial effects reported in Tables 1 and 2

show that there needs to be some kind of interregional link between the

regional entities of the Russian Federation. Assuming this link to be based on

the diffusion of knowledge is, at least from a Western European perspective, a

viable option.

If the time horizon is cropped to allow for the use of the patents at

the EPO[11]

and active as well as passive patent citations[12] -

as proxies for the in- and outflow of codified knowledge - and inventor inflows

and outflows[13]

- as proxies for the in- and outflow of tacit knowledge[14].

Tables 3 and 4 capture the results of the extended models[15].

The basic impacts of the variables that were previously implemented do

not change and the qualitative indicators also do not change significantly.

Thus, knowledge spillovers are rather unimportant for Russian regional growth

and Russian regional growth benefits more from domestically generated and

available knowledge than from foreign knowledge. The patent variable - a proxy

for the generation of new codified knowledge - is only in rare cases

significant. Thus, tacit knowledge - researchers and students - plays a more

important role in regional growth than codified knowledge.

The results of this extended model show that the results discussed above

remain stable - not alone regarding their signs but also regarding the

coefficients - showing that they are independent of interregional knowledge

spillovers[16].

In light of the fact that most of the spillover variables are

insignificant in at least one sub-period it not possible to deduce a consistent

result as to the impact of knowledge spillovers. One minor insight arises as

both patent citation variables are positive and, at least in the later years,

also significant. Patent citations can also be viewed as an indirect indicator

of the presence of a significant research structure which generates the patents

and a pool of qualified inventors that are involved in the respective research.

Therefore, this positive impact can be viewed as a sign that a better research

system and better legislation regarding practical research will be beneficial

for the economic development of a region.

Finally, as the spatial term remains highly significant even though not

all of the spatial interactions are covered by knowledge spillovers. Especially

since the importance of the spillovers is rather marginal there are more

important links between the regions besides knowledge flows that have not been

explicitly included into the model.

Conclusions

The present study analyzed economic growth dynamics across the regions

of the Russian Federation. Besides proving the path-dependency of Russian

economic growth on a regional level, as well as its dependence on oil and gas,

it has been shown that knowledge does and always has played an important role

in the regional economic growth process. Here it is mostly researchers and to

some very minor degree the amount of students - as proxies of the stock of tacit

knowledge - that enhance economic growth while the amount of new patents - as a

proxy of the codified knowledge generated in each period - and most knowledge

inflows or outflows do not influence the economic development in any way.

In particular it has been shown that the impact of a doubling of the

output of the oil and gas sector does generate less additional economic growth

than a doubling of the number of researchers. Considering the future

development of the Russian Federation it is an important insight especially

since the result remains stable even during the transition years. It shows not

only that science intensive sectors are benefactor of economic growth but also

that the main dynamics of economic growth work comparably to Western European

economies. Russia can therefore learn from their growth strategies and

structural change programs to switch from being a resource-based to being a

knowledge-based economy.

[1]See Machlup

(1960) or Machlup (1962).

[2]While the

results in Netter and Megginson (2001) strengthen this argument, for the

Russian Federation Berkowitz and DeJong (2003) show that ownership has no

impact on firm performance; they instead highlight more the firms' distance

from Moscow, which in this study is implicitly included in the fixed effects.}

[3]It would be more

suitable to include a variable like the Corruption

Perception Index, or the ICRG index

of corruption advocated by Kim (2010) or the Bribe Payers Index advocated by Ofer (2010); however, they are not

available on a regional level for a continuous span of years. Note as well the

arguments by Brown and Shackman (2007) who link

corruption and the long-term development of the GDP per capita and a continuing

deterioration of law and order.

[4]Refer for the

resource curse hypothesis to Auty (1993), for example.

[5]For the Russian

Federation Popov (2001) for example stresses the importance of the level of

export shares for the regional performance.

[6]See Doehrn and

von Westernhagen (2003) as one article that stresses the importance of FDI for

growth in transition economies.

[7]See Blundell and

Bond (1998) and Bond et al. (2001) who consider the Blundell-Bond estimator to

be superior to the Arellano-Bond estimator in a growth related context.

[8]In total 80

regions have been considered. The three sub-regions of the Tyumen Oblast have

been jointly considered as well as Archangelsk and the Nenetsia Autonomous

Okrug.

[9]For reasons of a

better readability the coefficients for the openness variable has been multiplied

by the factor thousand.

[10]In other words raising the number of researchers by one percent leads to

rise in GDP by 0.32% while a one percent rise in oil and gas output only leads

to a rise in GDP by 0.05% to 0.07% - considering that researchers are measured

absolutely and production of oil and gas in thousand tons.

[11]As only a

version of the Patstat database from early 2008 has been available,

comprehensive patent data has only been available up to 2006.

[12]An active patent

citation takes place if an inventor from the region under consideration cites

another patent, whereas a passive patent citation takes place if a patent is

cited of which one inventor is registered living in the region.

[13]An inventor

inflow is registered if a patent is granted with an inventor being listed as

living in the region who has been listed in a previous patent as living in a

different region. Inventor outflows are defined vice versa.

[14]All patent

citation as well as inventor flow variables are

calculated based on EPO patent data, thereby accounting only for internationally

important knowledge.

[15]For a better

readability the coefficients of the patent and the four spillover variables

have been multiplied by a factor of thousand.

[16]Only the students variable - before significant and positive in the

later years - becomes insignificant in the extended model.

Bibliography

Ahrend, R., “Speed of Reform, Initial Conditions, Political Orientation,

or What? Explaining Russian Regions’

Economic Performance”, DELTA Working Paper, 2002-10, 2002.

Auty, R.,

“Sustaining Development in Mineral Economies: The Resource Course Thesis”,

Routledge, 1993.

Berkowitz, D. and DeJong, D., “Policy Reform and Growth in Post-Soviet

Russia”, European Economic Review, 47, 337-352, 2003.

Blundell, R. and

Bond, S. “Initial Conditions and Moment Restrictions in Dynamic Panel Data

Models”, Journal of Econometrics, 87, 115-143, 1998.

Bond, S.; Hoeffler, A. and Temple, J., “GMM Estimation of Empirical

Growth Models”, CEPR Discussion Paper, 3048, 2001.

Brown, S. and

Shackman, J., “Corruption and Related Socioeconomic Factors: A Time Series

Study”, KYKLOS, 60, 319-347, 2007.

Doehrn, R. and von Westernhagen, N., „The Role of Foreign Direct

Investment in Transformation“, In Lane, T; Oding, N. and Welfens, P.J.J.

(Eds.), “Real and Financial Economic Dynamics in Russia and Eastern Europe”,

251-278, Springer, Heidelberg, 2003.

Guellec, D. and

van Pottelsberghe de la Potterie, B., “From R&D to Productivity Growth: Do

the Institutional Settings and the Source of Funds of R&D Matter?”, Oxford Bulletin of Economics and Statistics, 66, 353-378,

2004.

Kim, M.J., “Corruption and Economic Growth”, EACGS Conference, 2010.

Lichtenberg,

F.R. and van Pottelsberghe de la Potterie, B., „International R&D

Spillovers: A Comment“, European Economic Review, 42, 1483-1491, 1998.

Machlup, F., “The Supply of Inventors and Inventions”,

Weltwirtschaftliches Archiv, 85, 210-254, 1960.

Machlup, F., “The Production and Distribution of Knowledge in the U.S.”,

Princeton University Press, Princeton, 1962.

Netter; J. and

Megginson, W., “From State to Market: A Survey of Empirical Studies on

Privatization”, Journal of Economic Literature, 39, 321-389, 2001.

Ofer, G., “Twenty

Years Later and the Socialist Heritage is Still

Kicking”, UNU-WIDER Working Paper, 59, 2010.

European Patent

Office, “Patstat Database”, http://www.epo.org, 2007.

Popov, V., “Reform Strategies and Economic Performance of Russia’s

Regions”, World Development, 29, 865-886, 2001.

Rosstat, “Regiony

Rossii”, http://www.gks.ru, 2012.

Surinov, A., “Voprosy Kolichestvennoj Otsenki Mezhregionalnykh Indeksov

Tsen”, Ekonomicheskij Zhurnal VSHE, 4, 604-613, 1999.

World Bank, “World

Development Indicators Database”, http://www.worldbank.org, 2012.

Appendix

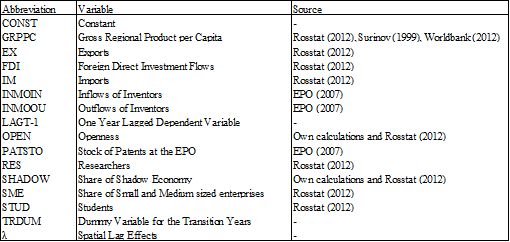

A.1 Abbreviation of Variables

The abbreviations used in the presentation of the econometrical results

are summarized in the following table. It also contains the data sources of the

variables.

Table 5: Abbreviation of

Variables

*Jens K. Perret - European Institute for International Economic Relations at the University of Wuppertal

Rainer-Gruenter-Straße 21 42119 Wuppertal, Germany. Tel.: +49 202 439 3174 e-mail: perret@wiwi.uni-wuppertal.de

© 2010, IJORS - INTERNATIONAL JOURNAL OF RUSSIAN STUDIES